The 30-Second Trick For Payroll Taxes Offer In Compromise

Wiki Article

Facts About Audit Protection Annual Plans Revealed

Table of ContentsFacts About Tax Lien Releases UncoveredLate Or Unfiled Irs Tax Returns Can Be Fun For EveryoneThe Definitive Guide to Corporate Tax ServicesTax Audit Defense - QuestionsSee This Report on Protecting Assets After Assessment

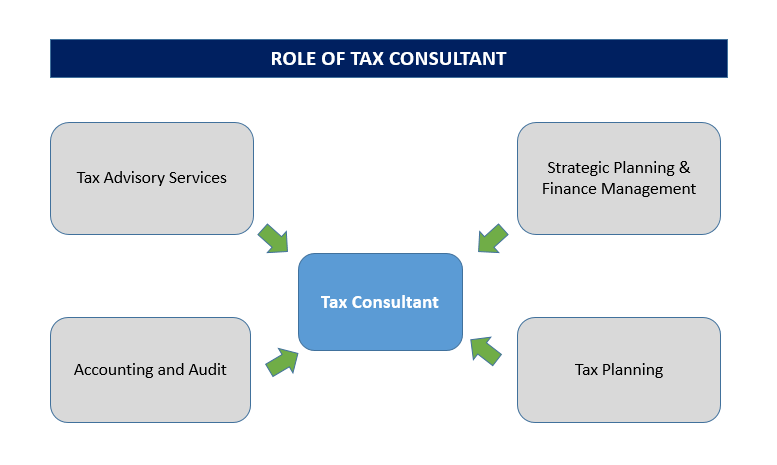

Providing a reward and/or discount rate to clients that offer referrals is a great way to boost your business. Get out as well as around as well as end up being recognized as the "tax obligation expert". For sales tax outsourcing, R&M provides a turnkey, total indirect tax service that is composed of safe and secure data transfer, information conversion, manual calculations, as well as exact tax return and repayment processing.We have actually aided many global firms browse the challenging globe of tax obligation conformity, giving us the side to sustain you rapidly, properly, and with confidence. RSM Jordan takes your business needs seriously as we build your custom tax solutions, assisting us produce tax obligation preparation methods that supply. Several of the tax consultancy solutions we cover consist of: Tax obligation planning to stay clear of extreme tax obligation expenses, making use of possibilities within tax regulation Coverage any type of weak web links in your corporate tax method Preparing and sending your yearly income tax return Expert tax suggestions on examinations related to basic tax obligation matters Attending examination sessions normally held by the assessor as well as going over the end results as well as verdicts Normal records on legislation modifications that impact your service Establishing specialized tax solutions and approaches to reinforce your current tax version When your company needs tax obligation consultancy solutions, contact us with our experts - Company Formation Assistance.

An Unbiased View of Payroll Taxes Offer In Compromise

What Is a Tax Obligation Preparation Service? Tax obligation prep work solutions mostly focus on preparing your tax return. Some may also use tax preparation solutions to assist you reduce your taxes due anonymous in the existing and also future tax obligation years. They might offer other services such as bookkeeping, auditing, or consulting. These services need to not make pledges of a specific reimbursement quantity or an assured method to lower the tax obligation you'll owe.

After completing your return, your preparer needs to authorize the return as a paid preparer. They might also e-file your return for you. You may bring your tax paperwork and also rest with the preparer as they deal with your income tax return. Other workplaces may permit you to leave your documentation and prepare your return for you at a later date.

Examine This Report on State Of Michigan Tax Notifications

The VITA program provides complimentary tax obligation prep work help to those that qualify. On the various other end of the range, Certified public accountants most likely charge the most for their services, which might encounter the hundreds or countless bucks - Corporate Restructuring. Some tax prep work services might allow you to pay for their cost out of your refund, yet this practically comes to be a financing and has other costs included.How Is a Tax Obligation Preparation Solution Different From Tax Prep Work Software Application? A tax preparation service prepares your income tax return in your place. They authorize the income tax return as a paid preparer. When you approve the return, they can even submit the tax return on your part. Tax preparation software requires you to input the information, which is after that moved to the tax obligation return forms.